(G.N.S) Dt. 27

Mumbai/ New Delhi

In view of the Covid19 pandemic, the Reserve Bank of India has reduced the repo rate by 75 bps to 4.4%.

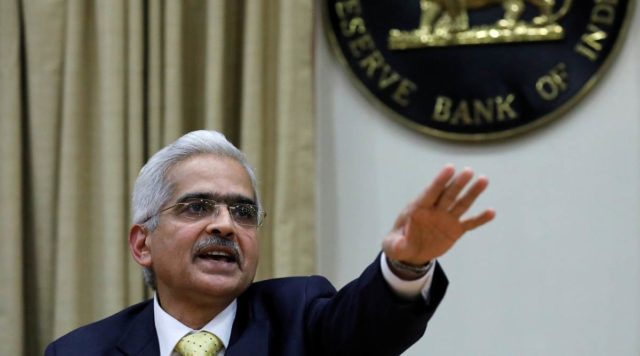

advanced its monetary policy committee meeting and voted for sizable reduction for policy rate, RBI Governor Shaktikanta Das said in a press conference in Mumbai. “Four out of six members voted for 75 bps cut,” he added

Acknowledging that war effort is mounted to combat the novel coronavirus, Mr. Das said it is worthwhile to remember that tough times never last. “The RBI is monitoring evolving market and macro economic situation. Our effort is to preserve macroeconomic stability,” he added.

Here are the highlights:

- RBI reduces policy repo rate by 75 bps to 4.4%.

- RBI has taken several measures to infuse liquidity.

- RBI conduct long term repo operation (LTRO) auction of Rs. 1 lakh crore of three years maturity. The first auction of Rs 25,000 crore will be conducted today.

- The cash reserve ratio (CRR) has been cut by 100 bps for one year. It will now be 3%.

- The marginal standing facility (MSF) has also been reduced.

- The LTRO and MSF cut is expected to infuse Rs. 3.74 lakh crore.

- The CRR cut will release Rs 1.37 lakh crore liquidity.

- All lending institutions allowed three month moratorium for all term loans.