(GNS, Akash Srivastava),

New Delhi, Dt. 3

, according to the information uploaded on the website of the Ministry of Corporate Affairs, Government of the Union Home Minister Amit Shah’s son Jay Shah’s business is growing. According to documents submitted to the ministry by Jai Amit Shah’s business firm Kusum Finserve LLP, Jai Shah is a partner appointed in the organization and his position is equivalent to that of the company’s director.

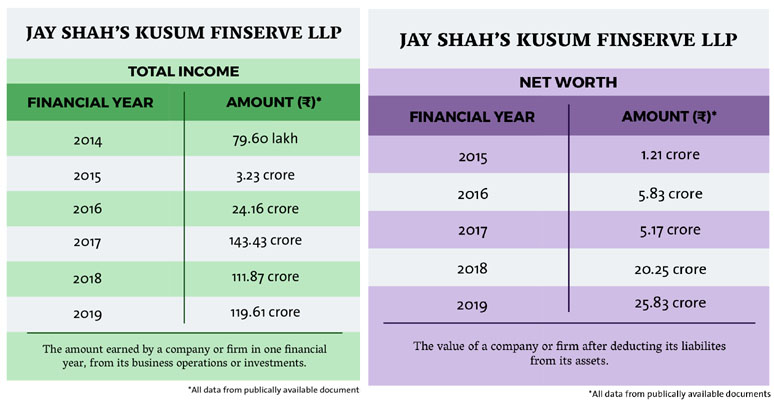

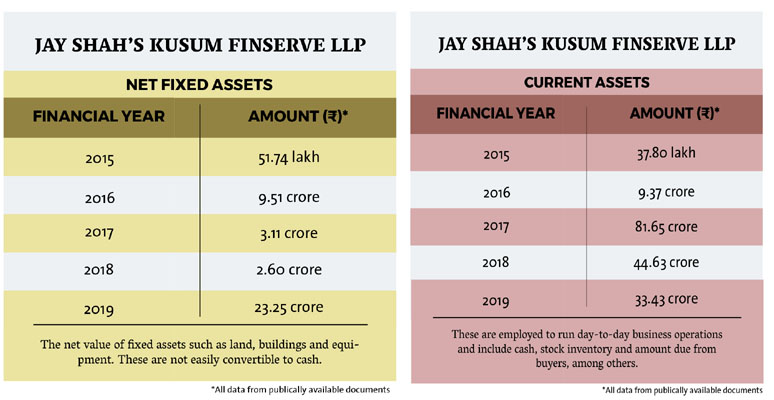

Since the Narendra Modi-led BJP government came to power in the Center, the total assets of Jay Shah’s generation Kusum Finserv have increased by Rs 24.61 crore from 2015 to 2019. Its net fixed assets include Rs. 22.73 crore, an increase of Rs. 33.05 crore has been increased and total revenue is Rs. 116.37 crore increase.

Jay Shah’s star shines in mid-October, having been elected secretary of the Indian Cricket Board. The organization manages cricket at the national level. There has been a stir in the country as the Carava website report is released. The full details of this are as presented here.

The Caravan reported in August 2018 that Jay’s Kusum Finserve had secured a dramatic increase in credit facilities since 2016 despite its poor finances in preceding years. In 2016, Amit Shah had mortgaged two of his properties to help secure a credit facility of Rs 25 crore for his son’s firm.

LLPs are required to file their statement of accounts by 30 October each year. Failing to do so is an offence under the Limited Liability Partnership Act, and can invite a fine of up to Rs 5 lakh. In January this year, The Caravan reported that the firm’s statements for the financial years 2017 and 2018 were still due. Even as the BJP government and the ministry of corporate affairs cracked down on firms that failed to file their financial statements, Kusum Finserve had missed its deadlines for two consecutive years.

The firm’s financial statements were resultantly not available for public viewing through the general election held earlier this year. The BJP won the polls with a resounding majority. Amit Shah, who won from the Gandhinagar constituency in Gujarat, was appointed the home minister in Modi’s second cabinet. The financial statements were uploaded in August 2019, nearly three months after the election result was announced. Though the firm has now filed balance sheets until the latest financial year, the documents offer no clarity on the nature of Kusum Finserve’s business. The Ahmedabad Registrar of Companies, under whose jurisdiction Kusum Finserve falls, did not respond to queries sent ahead of this article.

It is clear that in the years for which its statements were not available to the public, Kusum Finserve’s business expanded greatly. In the financial year 2015, the firm’s total income was Rs 3.23 crore. By the end of the financial year 2019, it had risen to a staggering Rs 119.61 crore. In the financial year 2017, Kusum Finserve clocked an all-time high total income of Rs 143.43 crore.

Between the financial years 2015 and 2o19, Kusum Finserve’s net worth multiplied from Rs 1.21 crore to Rs 25.83 crore. The financial year 2018 was evidently prosperous for the firm—its net worth jumped to a handsome Rs 20.25 crore from Rs 5.17 crore the previous year. The net worth of a firm is one of the parameters that indicates its financial health. Banks usually use this figure to ascertain whether a firm is eligible for loans—a positive net worth indicates a successful business.

Kusum Finserve, which was first incorporated in 2013 as a company and later converted to an LLP, has seen a good few years of profit as well. According to the documents filed with the MCA, Kusum Finserve suffered a loss of Rs 23,729 in the financial year 2014. It did exponentially better the next year making, a profit of Rs 1.2 crore after taxation. In 2016, it incurred a loss of Rs 34,934, but it has been in the green since. In the financial year 2017, its profit was Rs 2.19 crore, and in 2018, it was Rs 5.39 crore. In the latest financial year, it made a profit of Rs 1.81 crore. The latest decrease in profits may be explained by the rise in its operational expenses. According to the balance sheets, in the financial year 2019, the firm’s operational costs—its personnel and administrative expenses, and its expenditures on raw materials, power, fuel and insurance—increased, suggesting that the its business is scaling up.

One of the most prominent developments has been the growth in the firm’s net fixed assets—the net value of all assets such as land, buildings, machinery and the like, which have a long gestation period and cannot easily be converted to cash. From Rs 51.74 lakh in the financial year 2015, Kusum Finserve’s net fixed assets rose to Rs 23.25 crore in the latest financial year. This growth included two major surges. In the financial year 2016, it jumped to Rs 9.51 crore—a hike of 1,738 percent from the previous year. From Rs 2.60 crore in 2018, its net fixed assets jumped to Rs 23.25 crore in the financial year 2019.

Another key parameter that stands out in the balance sheets is the precipitous growth in the firm’s current assets—these are employed to run day-to-day business operations and include cash, stock inventory and amount due from buyers, among others. From Rs 37.80 lakh in the financial year 2015, Kusum Finserve’s current assets rose up to an incredible Rs 33.43 crore in the latest financial year—an 88-times increase. The peak was registered in the financial year 2017, when the current assets were valued at Rs 81.65 crore, nearly 216 times the 2015 figure.

The firm’s growth has been fuelled by a rich stream of loans, both secured and unsecured—given by an individual or an entity, with or without a collateral, respectively. The firm’s financial statements show that it had access to unsecured loans until the financial year 2018. In 2013, when Kusum Finserve was a still a company, it declared a liability of Rs 16.36 lakh in unsecured loans—simply put, it had received this amount without giving a collateral, and was liable to pay it. In the financial year 2014, this liability increased to Rs 1.22 crore, and further to Rs 2.71 crore in the next financial year.

Notes to the balance sheet—an annexure that usually provides a detailed breakdown of a firms’ accounts—filed in the financial year 2014 show that a company named KIFS Financial Services Limited gave the firm the majority of its unsecured loans for the year: Rs 1.06 crore. The next year, KIFS raised its unsecured loans to Rs 2.68 crore, once again making it the major contributor in Kusum Finserve’s total unsecured loans. The firm’s unsecured loans doubled to Rs 4.92 crore in the financial year 2016. The documents that the firm filed to the MCA are silent on the sources of these loans, but in a response to The Wire, in 2017, Jay’s lawyer acknowledged that KIFS had granted this amount. “This entity has also been regularly raising ICDs / loans from KIFS Financial Services for the last several years and the amount of Rs.4.9 crores was the outstanding closing balance from them,” the lawyer wrote. “These amounts were used for regular working capital. Tax has been deducted on the interest paid (TDS) and principal and interest amount has been repaid in full.”

According to its website, KIFS is a “Non Banking Financial Company registered with RBI under the Category of Loan Company and is a Subsidiary Company of KIFS Securities Limited.” Its chairman and managing director, Rajesh Khandwala, is related to Parimal Nathwani, a member of parliament in the Rajya Sabha. Nathwani is the senior group president of Reliance Industries Limited and a former vice president of the Gujarat Cricket Association. Amit Shah was formerly the president of the GCA and Jay served as a joint secretary. Nathwani and the Shahs stepped down from the GCA in late September 2019.

In the financial year 2017, Kusum Finserve’s unsecured loans increased to an all-time high of Rs 15.68 crore. The 2017 statement did not include any notes. In the next two financial years, the company declared no unsecured loans.

The rise in secured loans is equally steady, but unclear. The statement for the financial year 2016 stated that it had a liability for a secured loan of Rs 3.95 lakh. The 2017 sheet stated that the firm’s secured loans rose to Rs 11.23 crore. By the latest financial year, this figure increased to Rs 25.50 crore. The notes to the sheet are sorely missed—without these, the sources of these loans are not known.

Impressive rises in business is not unprecedented for Jay Shah. In late 2017, The Wire reported on the financial affairs of Temple Enterprise Private Limited, another business owned by Jay. Temple Enterprise saw a meteoric 16,000-fold rise in its turnover. After a few years of showing either negligible profits or losses, in the financial year 2015, Temple Enterprise reported Rs 50,000 in revenue. The following year, its turnover skyrocketed to Rs 80.5 crore. In October 2016, however, Temple Enterprises seemingly stopped doing business altogether. It declared in its director’s report that the net worth of the company had “fully eroded.”

In its August 2018 story, The Caravan noted that Jay’s business appeared to have shifted to Kusum Finserve. Even though the firm showed a net worth of only Rs 5.83 crore in the financial year 2016, it had secured credit facilities amounting to Rs 97.35 crore since then, in tranches of Rs 10.35 crore, Rs 25 crore, Rs 15 crore, Rs 30 crore, and Rs 17 crore.

The credit and loan facilities to Kusum Finserve came from two banks and one public-sector undertaking. The Kalupur Commercial Co-Operative Bank had extended a credit facility of Rs 40 crore to Kusum Finserve LLP, in tranches of Rs 25 crore and Rs 15 crore. Amit Shah mortgaged his properties for the first tranche, effectively becoming liable for his son’s firm. Presently, according to the index of charges for Kusum Finserve listed on the MCA website, the credit facility extended by the cooperative bank and the accompanying charge has been discharged.

In 2016, the Indian Renewable Energy Development Agency Limited, a public-sector undertaking managed by the ministry of new and renewable energy, extended a loan of Rs 10.35 crore to Kusum Finserve. Kotak Mahindra Bank had taken an exposure of Rs 47 crore—in 2017, it extended a letter of credit to the firm for Rs 30 crore, and in 2018, it granted the firm a loan of Rs 17 crore. Kusum Finserve mortgaged a property in Sanand for this loan, which had been allotted to it by the Gujarat Industrial Development Corporation.

This means that Kusum Finserve had a credit facility of Rs 30 crore, and loans of Rs 27.35 crore. According to the index of charges on the MCA website, these still stand. In the absence of notes for the latest balance sheets, it is not possible to tell whether Kusum Finserve employed the credit facilities extended to it. It is also unclear why the loans it received appear not to agree with the secured loan amount it declared in its latest balance sheet—Rs 25.50 crore.

The documents that Kusum Finserve has filed in the last few years provide no clarity on the nature of its business. Jay’s lawyer had said in his response to The Wire that Kusum Finserve is “engaged in the business of trading in stocks and shares, import and export activities and distribution and marketing consultancy services.” The firm’s 2015 sheet stated that it is also engaged in “agro commodity”—but “consultancy” accounted for over 60 percent of the total turnover of the firm, and trading in agro commodities accounted for a little less than 29 percent. A record pertaining to the credit facility extended by the Kalupur Bank included a reference to “coal and coke trading business.” The Caravan reported earlier that the firm had set up a sizeable factory on the mortgaged land in Sanand. When I visited the plot in 2018, there were no signs or boards to indicate the name of the firm, and the guard denied me entry. According to bank documents for the credit facilities, the factory manufactures PP, HDPE and jumbo bags. At the factory site, there were no indications of what it manufactured.

The Caravan sent a detailed list of queries to Jay Shah on 19 October, regarding the financial documents. These sought responses on the nature of Kusum Finserve’s business; details that are not included in the filings; and the details of the credit facilities and loans, among others. At the time of publishing, he had not responded. The article will be updated if a response is received.